Avoiding value traps

“When you get to a recessionary environment, you don’t want to be going anywhere near the growth style, and you want to be holding as much value as you can”

Kasim Zafar

The Allianz UK Opportunities portfolio is currently running closer to its 50-stock threshold after Tillett added to his domestic exposure following the Brexit vote, primarily in the mid and small-cap areas of the market.

The fund’s top 20 holdings cover a wide range of sectors and include windows and door components company Tyman, wealth management firm St James’s Place and property firm Land Securities. Other stocks to feature in the top half of the portfolio include advertising company Ocean Outdoor, tobacco giant Imperial Brands and African-focused mining company Capital Drilling.

Tillett says when he invests in a stock it involves a certain element of ‘myopia’ on the basis the market is overly discounting a negative. This could be something specific to the company, the market it operates in, or a short-term issue or perhaps not even an issue at all.

While he typically invests on a five-year view, this does not necessarily mean he holds stocks for the entire five years. ‘I’m very valuation driven, so I will change my view if the valuation moves and it no longer makes sense to hold the stock,’ he says. ‘But I am fundamentally driven with a long-term horizon,’ he comments.

STRUCTURAL CONCERNS

A key part of Tillett’s process is to avoid value traps, which is something he suggests a value investor can be prone to. He notes the UK is particularly interesting as there have been quite a few high-profile value traps over the last few years, especially within the retail and real estate sectors.

He says, while there has been a de-rating in these sectors, opening up potential value, there are also inherent structural problems with a number of companies housed in these sectors.

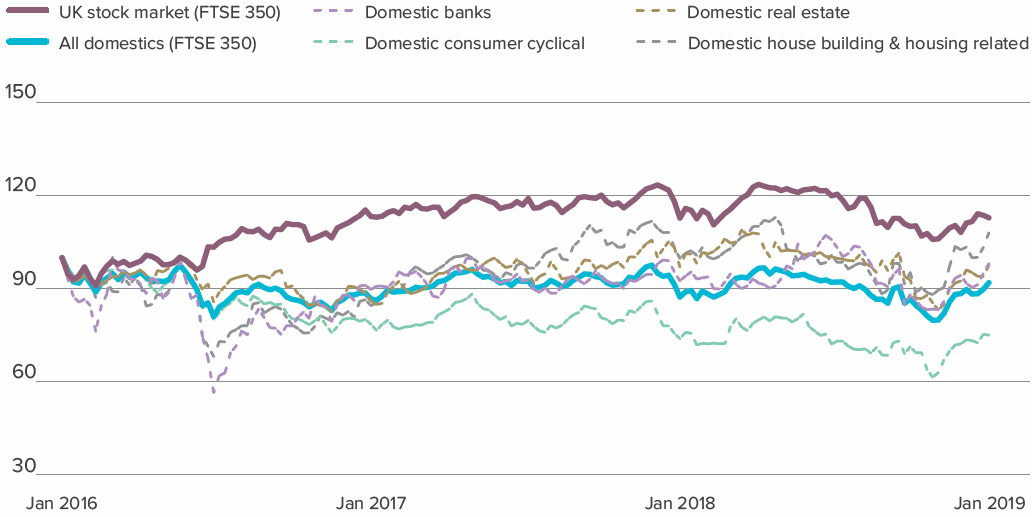

‘Since Brexit, we’ve had significant underperformance of these sectors. We’ve had de-rating almost across the whole group, but it’s important to understand these sectors have structural issues here as well, which is not just linked to UK economic sentiment,’ he explains.

‘If you take the consumer sector, there is a clear structural problem facing businesses that sell your traditional consumer products, particularly high street retailers.’

However, the indiscriminate sell-off since the Brexit vote has presented value opportunities in this domestic-focused sector, which has seen a number of companies unfairly sold, according to Tillett.

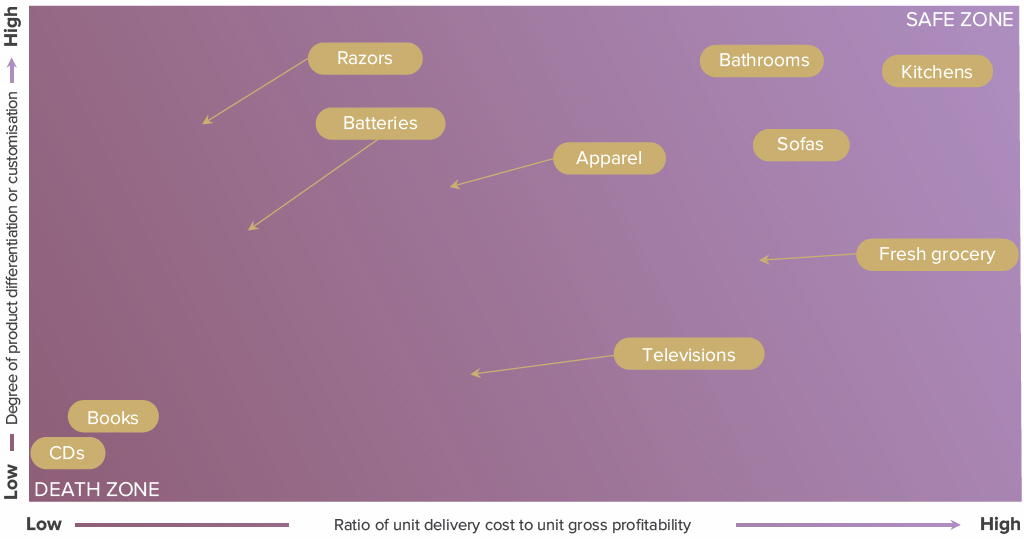

‘Since Brexit I’ve started looking at this area again because there’s a lot of value on offer. I’m trying very hard to identify those product categories and those companies that are highly attractively valued, but at the same time are not exposed to these structural pressures,’ he highlights. ‘The framework I use to look is what I call the delivery cost. So how easy it is to deliver the product and look at it in relation to the product’s gross profitability.’

UK domestics – bumping along the bottom

OF FUTURE RESULTS.

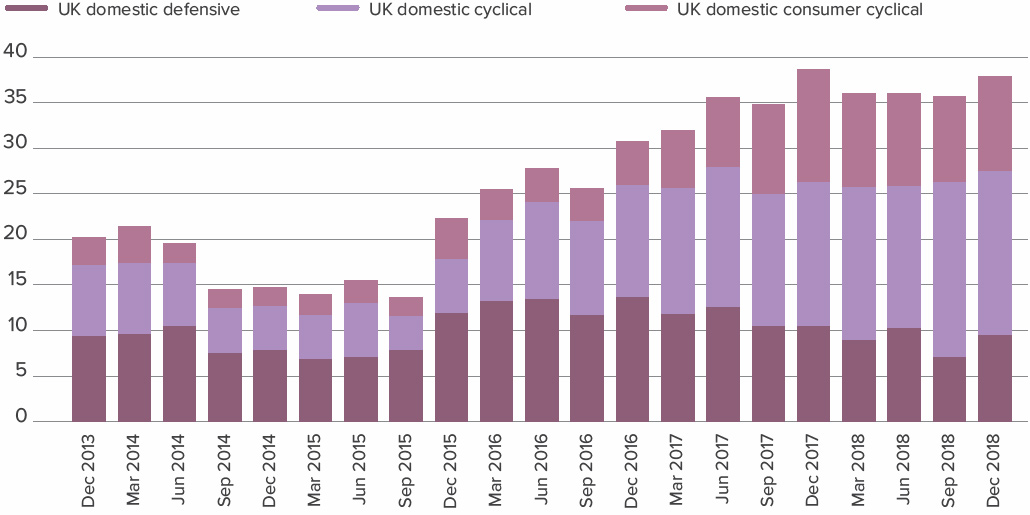

Allianz UK Opportunities – domestic exposure*

SOFA SO GOOD

The other variable Tillett considers important is the extent to which the product is differentiated or customised. ‘So, when you buy it, is there an element of it that is unique to you? Do you need assistance when you buy it? Do you need to speak to someone? Do you need to go and see it physically, sit on it?

‘If you can find product categories that score well on both of those two categories, they’re much less likely to have their gross profit pool decimated by some online start-up because it’s going to be much harder for an online start-up to overcome those obstacles.’

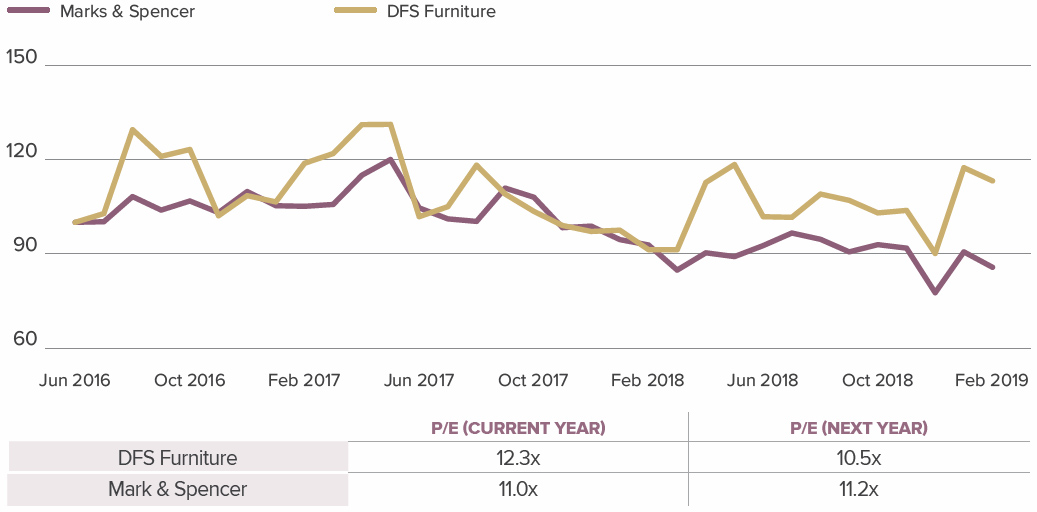

DFS Furniture is an example of a stock that fits this criteria. Tillett bought the furniture retailer just after Brexit when sentiment towards high street retailers was close to rock bottom. He was attracted by the firm’s 30% market share, well ahead of the 10% owned by its closest competitor.

Just as crucially, it has a high market share of the online market, with many of its digital competitors struggling to keep up with the firm. ‘The value’s there to see. You’ve got a company that’s taking market share, it is taking advantage of some of the weakness in the market to mop up some of the competitors,’ says Tillett.

‘You can buy it on essentially an ex-growth valuation and that’s after it’s re-rated. It was on eight or nine times when we were buying it and there are other examples like this.’

On the flipside Marks & Spencer could be a value trap. ‘I’m not saying Marks & Spencer is necessarily a sell, but I look at them and I can see they’ve got a structural problem,’ Tillett says. ‘I’m not saying it’s going to go bust, but it’s obvious to me that that’s a business that is going to struggle to grow earnings.’

Tillett cites DIY retail chain Kingfisher and builders merchant Travis Perkins as others businesses facing structural problems, which has seen them losing market share to rival Howdens Joinery. ‘Howdens has a great business model. It’s consistently managed to take market share and grow and it’s done that even after Brexit because of its vertically integrated business model and because it sells into the trade channel, which is taking a share from the DIY channel.’

SUPERMARKET SWEEP

Heath-Thompson says he has met a fair few fund managers this year who have been travelling in the direction of domestic-focused stocks they perceive to be unfairly hit by Brexit. He cites supermarket chain Tesco as one such example. ‘A lot of people have moved into Tesco, which is probably quite contentious. But these are growing businesses that have been battered by Brexit and, in some cases, such as Tesco, it can be quite defensive as well. So I think there is a sweet spot for some of these markets.’

Toolan points out that in Brexit Britain time horizons are really important and for those with long-term visions there are clearly opportunities in UK equities. ‘Certainly, if you’ve got a relatively short-term view, trying to justify it is incredibly difficult,’ he says. ‘But there are international investors out there for sovereign wealth funds, maybe in the Scandinavian region, that take a very long-term view, who actually have a very different perspective. Because if you’re taking a 50-year view, the value is there and the opportunities are there.’

Zafar echoes this sentiment, pointing out that over five to 10 years you tend to make money by buying cheap companies, even if in the short term you might look quite foolish because of the Brexit scenario. ‘The valuation discount on the domestics is there. One thing we’ve seen some fund managers doing is taking advantage of that valuation opportunity, but doing it with defensive sectors.’

Tillett categorises domestically-focused companies as those which generate 75% or more of their revenues from the UK. Selective buying of stocks here has resulted in his fund’s exposure to the domestic segment rising to around the 40% mark. Within this, small caps with a market capitalisation of under £300 million account for around 35% of the fund, mid-caps with a value between £300 million and £3 billion around 40%, with around 23% in large caps.

Value trap or value opportunity? Consumer products

Disruption is real but not all product categories are the same

Value trap or value opportunity? Retail

Upholstery versus apparel / food: share prices (left) and valuation (below)

ACQUISITION OPTIMISM

The Allianz UK Opportunities fund was boosted by a surge in the price of financial services firm IFG Group, its fourth biggest holding, after it accepted a £206 million takeover bid by private equity firm Epiris at the end of March.

Tillett does not hold a stock on the hope it will get acquired. But with valuations so depressed in UK equities, he would not be surprised, based on his investment process, if some stocks he invests in do get swallowed up.

‘My colleague says holding a stock for a bid is the “last refuge of a scoundrel”. So, I would never buy something because I think it’s going to get bid for,’ he says. ‘But it is the nature of what I’m doing.

‘I am trying to find reasonably good quality companies on depressed valuations without structural issues. Those companies quite often do get bid for if you get the analysis right. I expect to get a bit of M&A most years.’

Generally Peters believes the smaller end of the UK equity market could offer investors some tantalising opportunities. ‘I spend a lot of time looking at private companies as well. And there are some really interesting opportunities in smaller companies, both in the current market as well as in private companies that may look to go public at some point in the future,’ he says.

However, the large-cap value with a domestic bias is the area of the market that excites Heath-Thompson the most. He does not think it is hard to find bargains in the FTSE 100 and if international investors return to UK equities, he believes large caps could be the real beneficiary.

‘If we’re saying this is maybe more of a tactical opportunity, you might get the most bang for your buck in the large-cap value space, for example,’ he says. ‘Banks, maybe good retailers, commodities might pick up the most flows.’

SPECIAL GARDEN

Lagarias identifies the commodities sector as the one he likes most due to the fact it is not really affected by Brexit, along with the expectation China is bound for a cyclical bounce.

The energy sector is one Wyllie also finds interesting as he still feels the supply dynamics are going to improve. He also picks real estate as another sector that is ripe for investment.

One stock, which he dubs a ‘special situation’, is Capital and Counties, which owns Covent Garden and the Earl’s Court development. ‘Five years ago, the Earl’s Court development was seen as the jewel in the crown. Now it’s the poison pill. Nobody wants it because it’s development property in the centre of London.

‘I think there’s still fantastic option value in that site, which has been marked down four times by the appraisers now,’ Wyllie says. ‘Meanwhile, Covent Garden, which is now 85% of the value of the company, is a great asset. It’s a tourist destination and it’s got reversionary yields.’

PROPERTY SWEET SPOT

Real estate is Tillett’s largest exposure, with his fund holding a wide range of companies in the sector, within the commercial sector both inside London and outside the capital catching his eye. Stocks he holds here include Helical, Palace Capital, Land Securities and U+I Group.

He believes there is a general misperception that commercial property is highly cyclical, originating from the major trouble it found itself in during the financial crisis, when firms had to issue rights issues to keep afloat.

‘If you look at why that actually happened, though, it was primarily because they went into the downturn with far too much leverage. It didn’t take much of a move in capital values for them to be in breach of all their covenants and, hence, having to raise a lot of money,’ Tillett explains. ‘The actual core business of commercial property is quite a defensive business with pretty predictable revenue streams.’

With companies spending the last five years deleveraging their balance sheets, Tillett views fundamentals in real estate to be much better than most people think. He also believes he has identified a ‘sweet spot’ outside of London, where rents are still sitting way below build cost and there is actually more demand for office space because so much of it over the last 15 years or so has been converted to residential.

‘So, for the first time in about 25 years, you’ve actually got undersupply of office space. That’s a real sweet spot for real estate because you can get rental growth simply by buying good assets and repositioning them.’