ADVERTISEMENT FEATURE

Allianz UK Opportunities Fund

Active is: An opportunistic approach to UK investing

Lead Portfolio Manager,

Allianz UK Opportunities Fund,

Allianz Global Investors

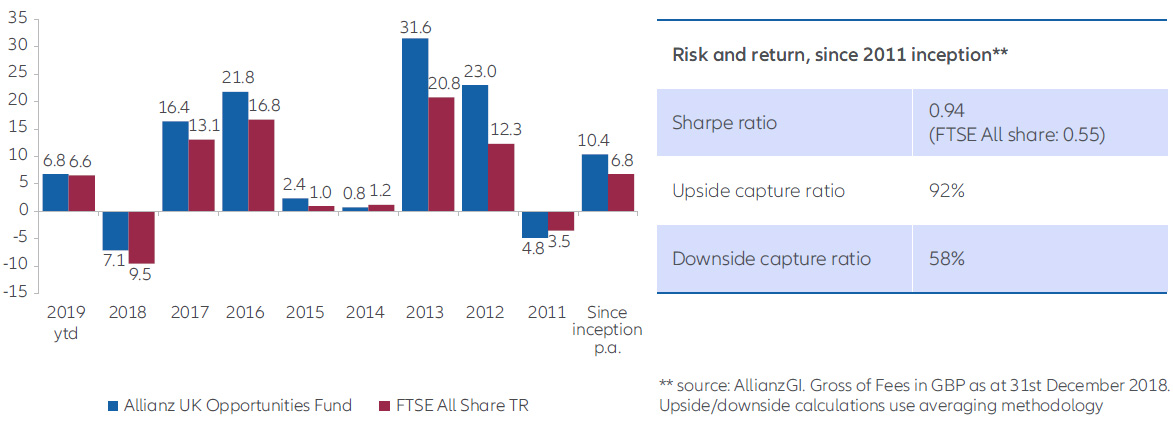

The Allianz UK Opportunities Fund has been managed by Matthew Tillett since its inception in 2011. Over this period, the Fund has delivered a strong and consistent performance, outperforming the FTSE All Share by 3.5% per annum with a highly favourable upside / downside capture ratio. This means investors have received a compelling performance outcome with a below average level of volatility. The fund is a top quartile performer over 3 and 5 years 1.

The Allianz UK Opportunities Fund aims to deliver risk adjusted returns that are significantly ahead of the FTSE All Share over the long term. It achieves this by investing in companies which we believe are materially undervalued relative to their assets or long-term earnings potential and where the downside risks are quantifiable and typically low. The Fund invests exclusively in UK equities, a market which due to its strong corporate governance and deep liquidity offers the ideal investment universe for an opportunistic stock picker.

A DIFFERENTIATED EQUITY FUND

The Fund is differentiated in a number of ways. A value driven and risk sensitive philosophy allows us to be highly selective in choosing investments, taking great care to avoid value traps. This selective approach results in a concentrated, high conviction portfolio that has the potential to deliver great long-term performance. A long time horizon allows the Fund to be patient, often taking advantage of contrarian valuation anomalies that may be caused by temporary or short term issues and stock market myopia. In contrast to many “buy and hold” strategies, the Allianz UK Opportunities Fund adopts a highly opportunistic approach, seeking out investment ideas from all across the market, recognising that source of these ideas can change significantly over time as market conditions evolve. These attributes mean the Fund’s strong performance is not overly dependent on any particular style or factor bias.

WHY NOW?

Brexit uncertainty has, in our view, created significant opportunity in UK equities. Both domestic and international investors have deserted the asset class, leaving relative valuations at their lowest since the 1980s. This exodus has left a treasure trove of investment opportunities to select from, particularly amongst small and mid-cap stocks where the impact of Brexit uncertainty has been greatest. Whilst there is still uncertainty over what post Brexit Britain will look like, whatever happens the economy will adapt, adjust and eventually more forward again. The Fund’s focus is on selecting robust business models that can thrive in most conceivable scenarios. Once the current state of political and economic uncertainty begins to subside, a strong a sustained valuation re-rating has the potential to drive a period of outsized returns.

A competitively priced share class is available to large investors, at 0.54% OCF2.

Discreet year performance since launch

For professional investors only. Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Allianz UK Opportunities Fund is a sub-fund of Allianz UK & European Investment Funds, an open-ended investment company with variable capital with limited liability organised under the laws of England and Wales. The value of the units/shares which belong to the Unit/Share Classes of the Sub-Fund that are denominated in the base currency may be subject to an increased volatility. The volatility of other Unit/Share Classes may be different and possibly higher. Past performance is not a reliable indicator of future results. Investment funds may not be available for sale in all jurisdictions or to certain categories of investors. For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact the issuer at the address indicated below or www.allianzgi-regulatory.eu. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established a branch in the United Kingdom, Allianz Global Investors GmbH, UK branch, 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk, which is subject to limited regulation by the Financial Conduct Authority (www.fca.org.uk).